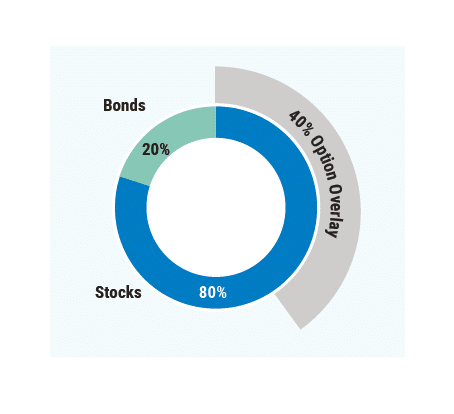

60/40 is Dead. Long Live 80/20/40.

The traditional 60/40 portfolio—a mix of 60% stocks and 40% bonds—is suffering through one of its worst periods in history. Although the demise of the 60/40 portfolio has been predicted before, investors may now face a new regime of high inflation and rising correlations between equities and fixed income.

Option Overlay: Solving Problems in Today’s Capital Markets

Investors in today’s capital markets face a variety of challenges, including the following: Stretched Valuations – This time is different?

Balancing Act: How To Readjust Soaring Client Portfolios Without Triggering Taxable Events

The current bull market is a boon for investors, but advisors are understandably wary. Up almost 280 percent since hitting its March 2009 low, record high after record high too often signals a downturn to come.